Insurance industry is a key driver of the net-zero economy

Life insuranceArticleNovember 29, 20244 min read

In response to the increasing global demand for governments, insurance firms, and financial regulators to disclose their respective climate-related impacts, risks, and opportunities, the world's first-ever report on transition plans for insurance companies was released at the recently concluded UN Climate Change Conference COP29 in Baku, Azerbaijan. During the event, the Forum for Insurance Transition to Net Zero (FIT) launched a report titled "Closing the Gap: The Emerging Global Agenda of Transition Plans and the Need for Insurance-specific Guidance."

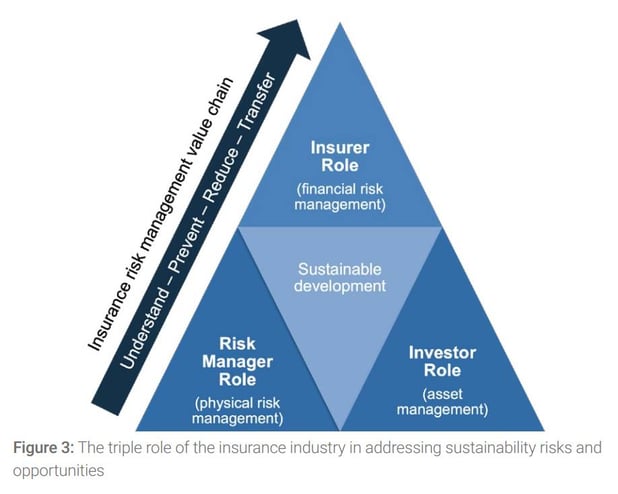

The report underlines the triple role of the insurance industry as risk manager, risk carrier, and investor in supporting the transition to a Net-Zero Economy, including the interrelated sustainability issues on climate. Because managing risk is an insurer's core business, understanding how insurers will adapt their business models, strategies, operations, and products and services in light of a changing climate is essential to an insurance company's transition plan.

Image Source: Closing the Gap: The Emerging Global Agenda of Transition Plans and the Need for Insurance-specific Guidance report.

As highlighted in the report, transition insurance can apply to many lines of business, across non-life and life and health insurance, focusing on climate solutions and enablers: low, zero or negative-emission solutions, and technologies.

Insurers can also create insurance products to address the social consequences of climate change, protecting vulnerable groups and businesses, including micro-insurance, unemployment insurance, life and health insurance, and climate-risk insurance for small enterprises.

Over the last couple of years, transition plans have emerged as a critical tool available to organisations on their journey to building a resilient net-zero economy. The development and disclosure of credible transition plans are essential for managing climate and other sustainability risks and opportunities, meeting regulatory and investor requirements, and demonstrating accountability and transparency to net-zero and sustainability commitments.

Zurich has recently published its own Climate Transition Plan, emphasising the importance of supporting the net-zero transition while enhancing societal resilience. The plan outlines four key pillars: enabling an economy-wide transition to net-zero by supporting customers and investee companies; making society more resilient by helping companies, cities, and communities understand and reduce risks; advocating for supportive policies to achieve a just and resilient transition; and evolving Zurich's operations by decarbonising its supply chain and investing in its people. This comprehensive approach aims to build climate resilience, ensuring economic success and social wellbeing throughout the transition.

The role of insurance in mobilising the climate transition

Recent reports by the Intergovernmental Panel on Climate Change (IPCC) outlined the urgent need for action in light of the triple planetary crisis of climate change, nature loss, and pollution issues that have a negative impact on economies across the globe. And, of course, these factors trickle down into the insurance industry. Reports also found that as a result of increased annual losses due to climate events, global insurance premiums for climate resilience and natural catastrophe protection could rise to almost 50% by 2030.

Another report by Howden and Boston Consulting Group highlights new research on the role of insurance in mobilising the climate transition. The findings indicate that more than half of the committed USD 19 trillion to finance the climate transition to 2030 will need additional insurance coverage. This pace in demand growth implies that corporates should engage the insurance industry early enough in the climate risk management planning process to secure adequate capacity and long-term coverage. This can be game-changing in unlocking climate finance at the speed and scale needed.

For life insurers, climate change subtly influences health, morbidity and mortality. Factors such as respiratory and cardiovascular complications developed by poor air quality due to increased pollution or smoke from wildfires, lead to higher morbidity and premature mortality. To address these issues, insurance companies, in collaboration with stakeholders, may invest in community health initiatives to raise awareness about the benefits of early disease prevention. Additionally, government support and incentives that reduce capital charges on assets or liabilities related to renewable energy projects could benefit society and lower insurers' risk profiles.

Many of the strategies currently being deployed for mitigating risk and incentivisation are still in early stages. As governing bodies, insurers, and vendors strive towards sustainability, insurers that can transform traditional mindsets and capitalise on opportunities will be in a better position to align profit with purpose.

References

https://www.unepfi.org/industries/insurance/transition-plan-guide/

https://www.reinsurancene.ws/insurance-is-vital-to-accelerating-climate-finance-howden/

https://www.howdengroup.com/sites/huk.howdenprod.com/files/2024-06/the-bigger-picture-whitepaper.pdf