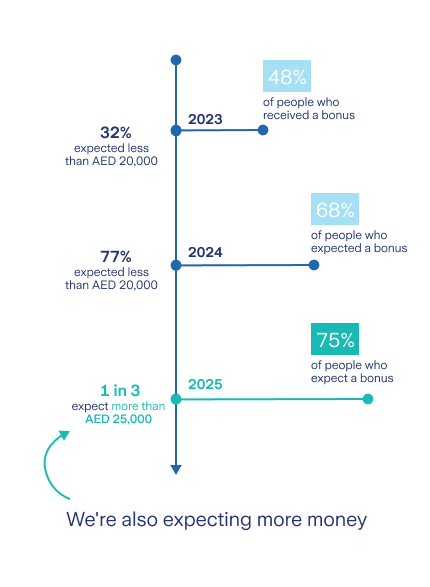

We're feeling bonus optimistic

Year-on-year bonus expectations in the UAE are rising, indicating increasing optimism about workplace financial rewards. This is likely influenced by confidence in the economy and corporate performance.

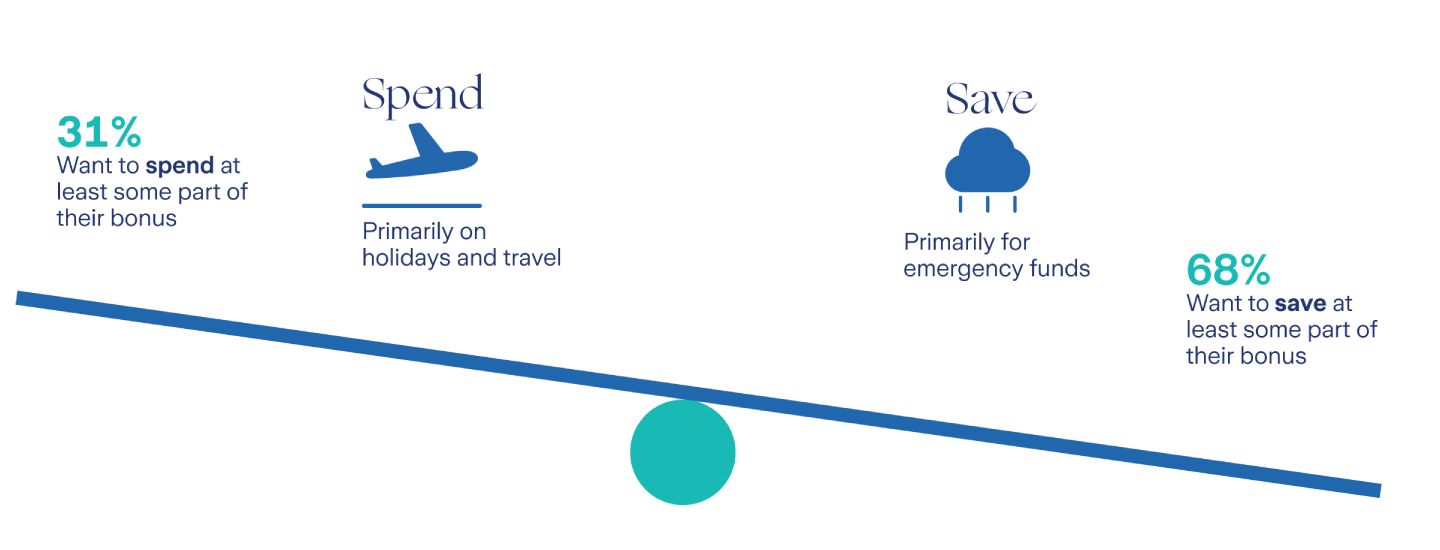

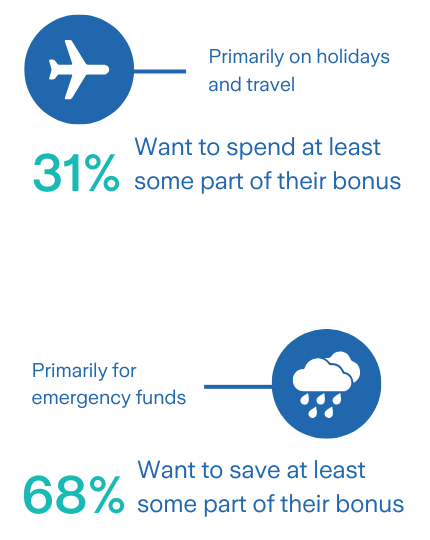

Do we spend or do we save?

The dual approach of spending while saving is becoming increasingly common among UAE citizens and residents. With a significant portion planning to save at least part of their bonus, these allocations reflect a thoughtful balance.

Breakthrough trend

27% people plan on investing in building skills like AI.

This reflects a trend of prioritizing financial security while valuing enjoyment and personal growth, fostering a balanced financial mindset nationwide.

Money matters change as per age

Citizens and residents in the UAE, particularly younger generations, are taking charge of their finances, focusing on long-term planning and stability. This trend highlights a cultural shift towards balancing saving and spending while prioritizing personal growth and experiences.

The great UAE retirement

7 out of 10

people want to retire here.

The highest proportion of this is within people earning a salary more than AED 25,000.

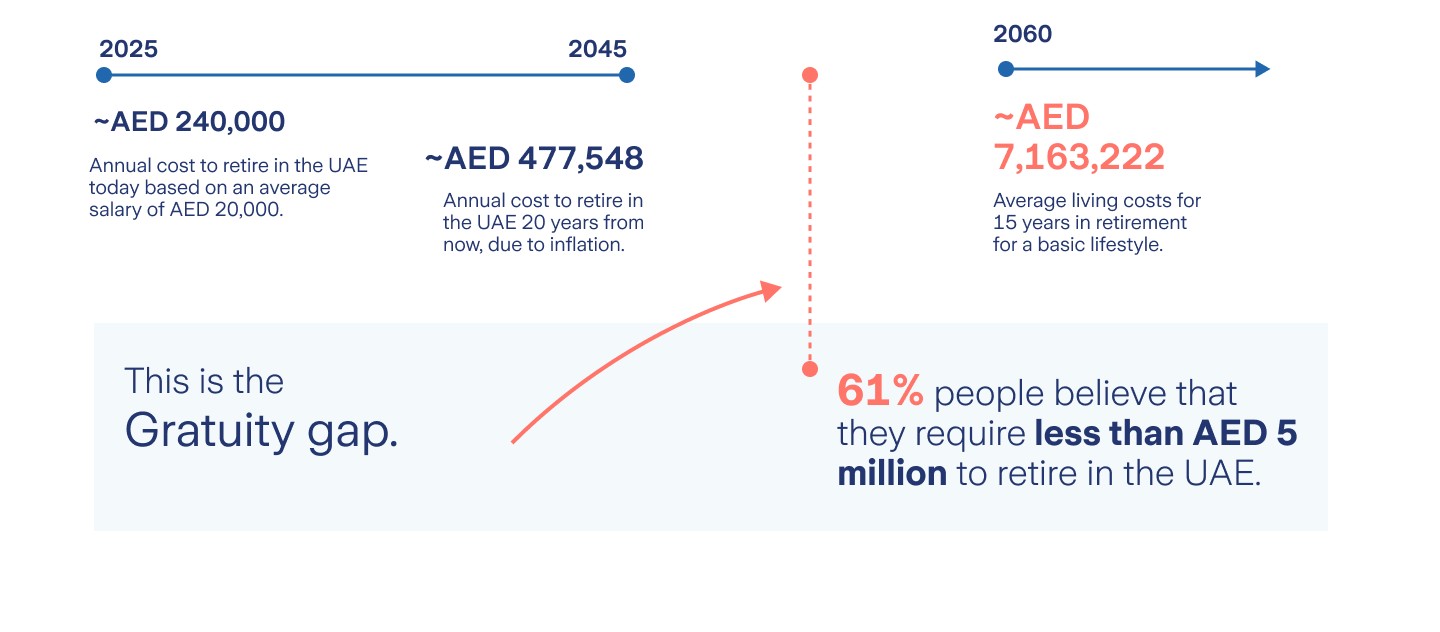

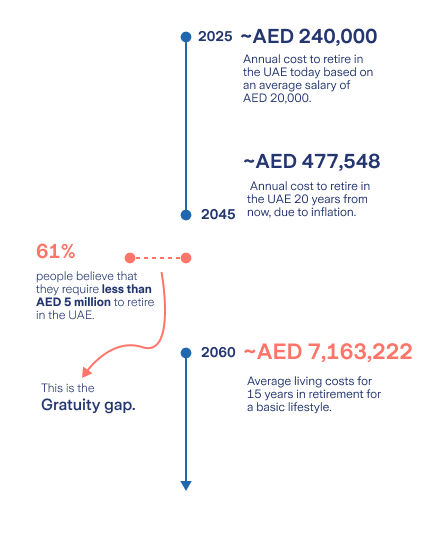

Are we really retirement ready?

75% Citizens and residents feel confident that they will have enough funds to retire. This confidence is higher amongst higher income groups and between Arab and Emirati nationalities.

However, we find a gap in retirement requirements.

65% expect their gratuity, workplace savings scheme, or other employer-provided savings scheme to be sufficient to fund their retirement.

However, the amount of gratuity payable to an employee during final settlement cannot exceed the employee's current total two-year salary.

Are we money-confident in the UAE?

68% People in the UAE feel confident about their current financial situation.

1 out of 2 People in the UAE have sought guidance from a financial advisor.

(This is up from 39% in 2024 to 68% in 2025.)